- Heads of Agreement executed for possible merger between DDT and Beston Technologies (BT)

- merger subject to, among other things, satisfactory completion of due diligence, negotiation of definitive transaction documents, final board approvals, DDT shareholder approval and completion of a capital raising

- DDT and BT have agreed to a period of exclusivity until 30 March 2018

- Merger would create an Australian-owned and integrated e-commerce traceability and anti-counterfeit software-as-a-service (SaaS) solution.

- Proposed merger terms value BT at $13.0 million and DDT at $7.0 million with a combined enterprise value of $20.0 million

- The Board of the merged group would comprise three directors appointed by Beston Global Food Company (BFC), the current ultimate holding company of BT, and two of the current directors of DDT

- A capital raising is proposed to be undertaken in conjunction with the merger to raise $12.0 million to $15.0 million

- At this point there is no assurance that the transaction will proceed to completion

DataDot Technology Limited (ASX: DDT) and Beston Global Food Company Limited (ASX: BFC) are pleased to announce that they have executed Heads of Agreement (HoA) in relation to a possible merger of BFC’s wholly-owned technology company, Beston Technologies Pty Ltd (BT), and DDT. The merger would be affected by the acquisition of all the shares in BT by DDT in exchange for the issue of DDT shares to BFC.

The proposed merger is subject to, among other things, satisfactory completion of due diligence by DDT and BFC, negotiation of definitive transaction agreements, final DDT and BFC board approvals, DDT shareholder approval and certainty of completion of a capital raising (discussed below).

Under the HoA, DDT and BT have agreed to an exclusivity period until 30 March 2018 (or such later date as they may agree) to complete due diligence and to seek to negotiate the definitive transaction agreements (including a merger implementation agreement).

The merger of DDT and BT would deliver an Australian-owned and integrated e-commerce traceability and anti-counterfeit software-as-a-service (SaaS) solution for brands from a broad range of industries.

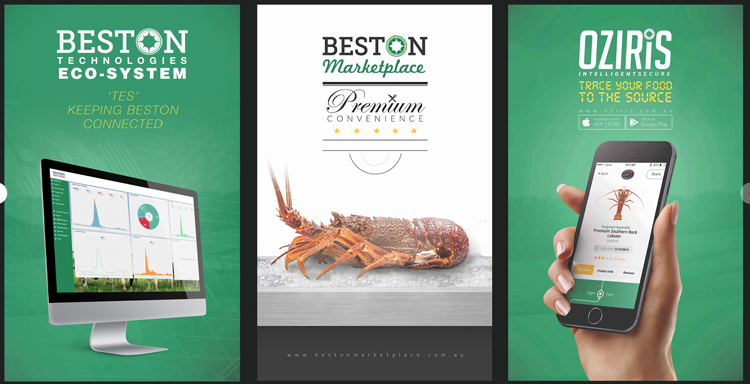

The business of the merged group (being the group consisting of DDT and BT) would have, as part of its strategy, a focus on “food trust” for consumers and will comprise the following core technologies and platforms:

- OZIRIS (incorporating Brandlok) – a consumer facing digital technology solution that authenticates and provides full ‘farm to fork’ traceability; see oziris.com.au/about-oziris/

- Beston Marketplace & 8ston – e-commerce platforms for the sale of food and beverage products in Australia and China; see bestonmarketplace.com.au and www.8ston.com

- a Technology Eco-System (TES) – comprising a central database, customer management, inventory management, fulfilment, reporting and analytics, and a supplier portal

- DDT’s patented DataTraceID covert authentication system that is currently deployed to authenticate pharmaceuticals, food and beverages, gaming chips and fabrics.

The Chairman of BFC, Dr Roger Sexton AM said that the businesses of BT and DDT were a good strategic fit and the merger of the two companies is expected to bring synergistic benefits that would not otherwise be achievable.

“The economic and financial logic supporting the proposed merger is compelling. The two businesses uniquely complement each other.

Combined, they would create a leading integrated e-commerce verification and anti-counterfeit software-as-a-service solution for both consumers and producers, able to punch above its weight in global markets.”

The Chairman of DDT, Mr Gary Flowers said that the merger would be transformative for DDT, taking the company to another level as an anti-counterfeiting technology product supplier and opening potential new opportunities for growth in product tracking and big data commercialisation.

“On every score – products, markets, IP, R&D and potential revenue synergies – the merger is expected to be a win-win for both companies and their shareholders”.